City hopes tax exemption bylaw pilot can revitalize empty downtown lots

Once there were three hotels west of 100 Street in downtown Fort St. John – the Frontier, the Condill and the Fort. Two burned down and one was torn down, leaving three large vacant lots.

Now the City of Fort St. John, after trying for years to attract development to the site of the former Fort Hotel at the corner of 100 Street and 100 Avenue, has decided to try using a revitalization tax exemption bylaw to spur interest in developing the most centrally located vacant lot.

Several municipalities in British Columbia, including Dawson Creek, have successfully used revitalization tax exemptions to incentivize development by creating a framework to defer or reduce tax for a period of up to ten years. These strategies support long-term economic development and revitalization goals.

Creating a revitalization tax exemption bylaw as a pilot project gives the city an opportunity to find out if this is something that helps attract developers and spur development in the downtown core.

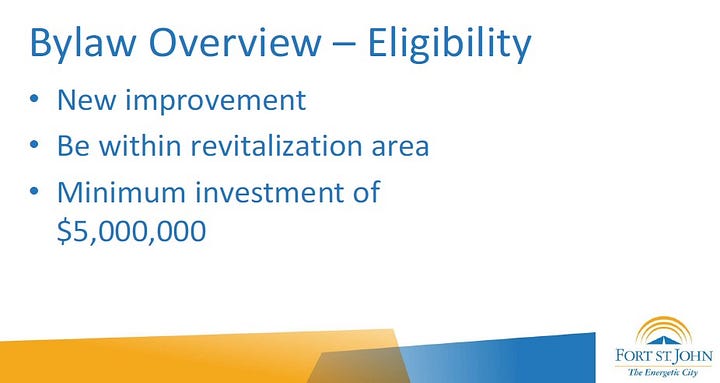

A revitalization tax exemption bylaw is a temporary exemption to help improve the marketability of the property. For example, Dawson Creek’s revitalization tax exemption bylaw applies to improvements to existing buildings in the city, for projects with a minimum investment of $75,000 and applies to the increase in assessed value of the improvements. Because the properties of concern in Fort St. John are vacant lots, the project value threshold will be much higher than Dawson Creek’s.

The terms for revitalization tax exemption bylaws can last for up to ten years in British Columbia, according to the Community Charter. The exemption starts at 100 percent, on land, improvements or both and decreases gradually over the term of the agreement with the developer.

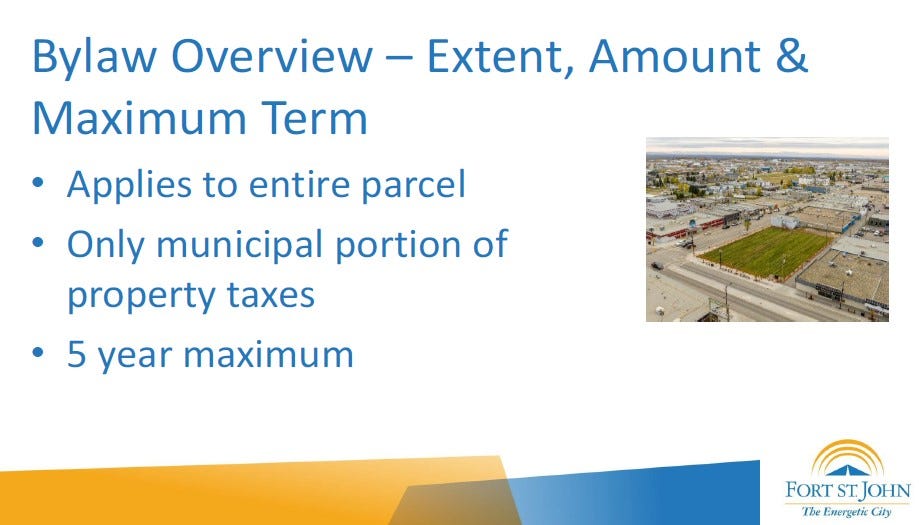

Although Mayor Lilia Hansen felt that including all three lots in the downtown core in the proposed tax exemption bylaw would give developers more flexibility, the draft bylaw presented to council during the Committee of the Whole meeting on June 9 has been designed with only the lot at the corner of 100 Street and 100 Avenue in mind.

“If the project is successful and helps spur downtown revitalization, the eligible area of the bylaw can be expanded to include other infill lots,” Sam Loran, Planner 1 with the city’s Development Services Department said.

As a city-owned property in a key location, the former Fort Hotel site has a good justification for a tax exemption and is ideal for mixed-use development, Loran said. Such a project will improve the vibrancy of the downtown, increase economic activity, create employment and improve the city’s tax base long-term.

“We want to attract a big multi-story building, so we have a high minimum investment,” he said.

That minimum investment is for new construction valued at $5 million.

The project must also be a mixed-use development, such as retail space on the ground floor and living space on the floors above.

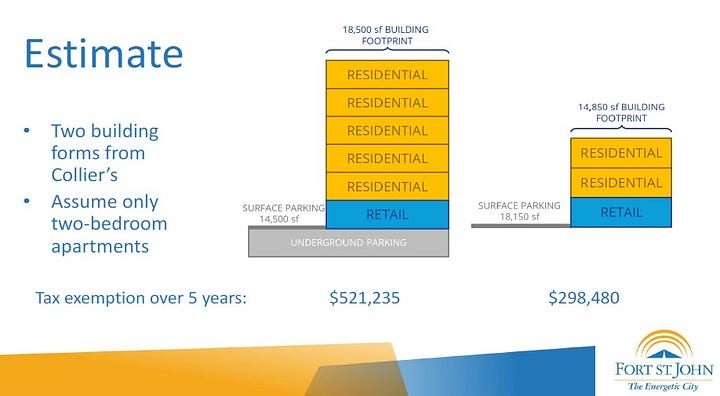

Loran’s presentation included options for tax emptions, extent and terms. Regarding the extent, whether tax exemptions will apply only to the assessed value of improvements, or if it will also apply to the assessed value of the land. Options for the terms if they will be provided for five years, or if the number of years a tax exemption is provided is tied to the construction value of the project.

Extent Options:

Option 1 - Exemption is equal to 100% of the municipal portion of property taxes imposed under Section 197(1)(a) of the Community Charter.

Option 2 - Exemption is equal to the municipal portion of property taxes imposed under Section 197(1)(a) of the Community Charter in relation to the improvements on the parcel.

Maximum Term Options:

Option 1 - Once the requirements under this bylaw are met, tax exemption under section 6.1 will be provided for five (5) years.

Option 2 - A project with a construction value of less than $15,000,000 is exempt from the amount calculated under Section 6.1 for a period of one (1) year. A project with a construction value of $15,000,000.01 - $25,000,000 is exempt from the amount calculated under Section 6.1 for a period of two (2) years. A project with a construction value of $25,000,000.01 - $35,000,000 is exempt from the amount calculated under Section 6.1 for a period of three (3) years. A project with a construction value of $35,000,000.01 - $45,000,000 is exempt from the amount calculated under Section 6.1 for a period of four (4) years. A project with a construction value of $45,000,000.01 or more is exempt from the amount calculated under Section 6.1 for a period of five (5) years.

Colliers, which the city engaged to assist staff with developing strategies to encourage development in the downtown core, recommended that for tax exemptions to be a worthwhile incentive, the city should issue a 100 percent exemption for a minimum of five years.

Loran told council that staff recommend Option 1 for both the extent and the maximum term of the tax exemption.

“I want to reiterate that municipalities have significant flexibility when creating tax exemption bylaws, so I encourage council to make any edits that they see fit,” Loran said. “We can also have more than one tax exemption bylaw for different areas, or different uses.”

Council largely agreed with Colliers’ assessment, but Mayor Hansen said she preferred Option 2 of an exemption on improvements only.

Overall, Hansen said she’s happy to see this proposed bylaw, as the city has aggressively tried to sell and attract investment on the property for years.

“As taxpayers we will get the benefit of seeing enhancement in our downtown, and after those initial five years, we will have that future revenue downtown,” she said.