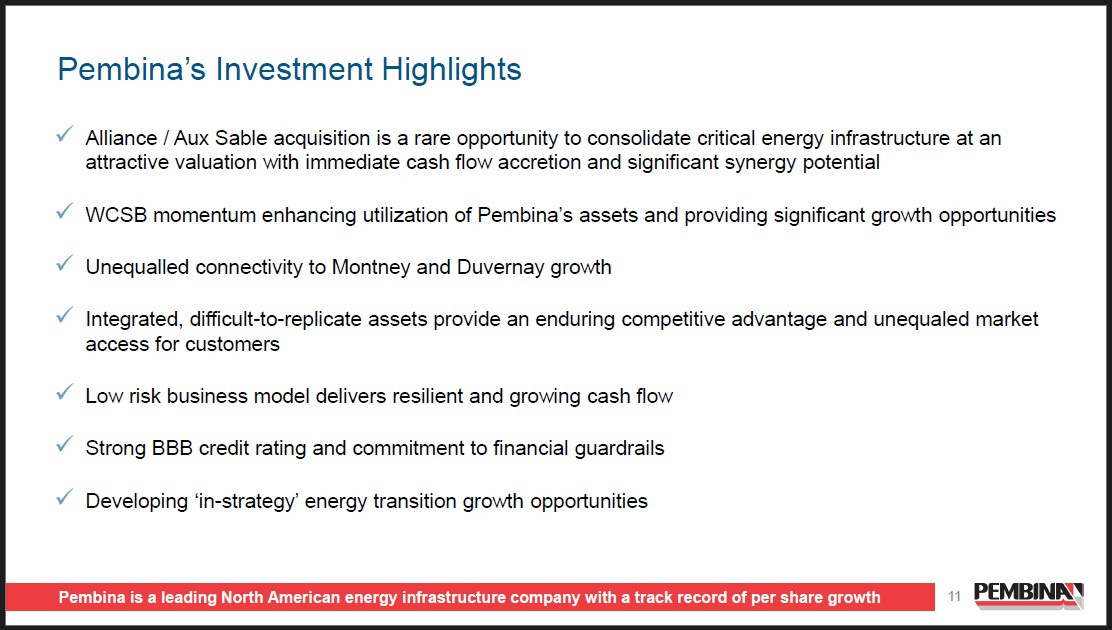

Pembina Pipeline is demonstrating its commitment to the natural gas industry in northeastern BC with its pending acquisition of Enbridge’s 50 percent share in the Alliance Pipeline. In partnership with Enbridge in Alliance since 2017, Pembina’s President and Chief Executive Officer Scott Burrows characterizes the acquisition as an opportunity to consolidate ownership in world-class energy infrastructure and strengthen the company’s growing franchise.

“It complements Pembina’s strategy of providing world-class, long-life resources in the Western Canadian Sedimentary Basin and access to premium end markets,” Burrows said.

In its 23-year life, Alliance has a strong record of reliability, high utilization and is unique in North America for its ability to transport liquids-rich natural gas, whilst acting as a valuable and cost-effective cross-border conduit for Canadian natural gas to access the high demand US markets, and the growing US Gulf Coast LNG export market.

“The natural gas industry is in a period of dynamic transition, in which supply and demand factors support a favorable outlook for both Alliance and Aux Sable,” said Burrows.

Existing production volume will continue to be drawn to the US markets in the south, while growing natural gas production in the WCSB, “most notably from the world-class Montney play, is expected to largely fill the approximately 2.8 bcf/day of new Canadian West Coast LNG export capacity.”

With its unique ability to transport liquids-rich natural gas, the Alliance Pipeline is essentially two pipelines in one, according to Cameron Goldade, Pembina’s Senior VP and Chief Financial Officer.

Built in 2000, the 3,719 km long pipeline extends from north of Fort St. John in northeastern BC, through Alberta, Saskatchewan, North Dakota, Minnesota, and Iowa before reaching its terminus in the Chicago, Illinois area. It transports 1.7 bcf/day of the Montney’s liquids-rich gas to Aux Sable’s Channahon Facility, which extracts the NGL from the Alliance gas.

“Since we acquired our current interest in these assets back in 2017, we have seen proof of the important role they play in the North American energy industry, and the advantages they bring to Pembina and its customers,” said Burrows. “We expect growth within the WCSB will continue into 2024 and beyond. Pembina is well-positioned to benefit from this transformational period in the Canadian energy industry.”

Burrows says that given the scope and reach of Pembina’s assets, highly economic expansion opportunities, existing long-term contracts, and commercial agreements with “premier northeastern BC producers, we are uniquely positioned to capture new volumes and benefit from the expected growth in the WCSB.”

Post-2030, by expanding Pembina’s US presence, Burrows expects that there will be an opportunity to grow Pembina’s marketing portfolio by approximately 100,000 bpd.

“We have identified incremental commercial integration opportunities to further bolster Pembina’s service offering,” he said. “The acquisition is expected to deliver $225 million to $250 million of incremental low-risk predominantly fee-based cashflow from operating activities with modest sustaining capital, in support of continued strategic growth investment and maintaining Pembina’s strong financial position.”

The acquisition is expected to be complete in the first half of 2024, subject to customary closing conditions. The purchase price of $3.1 billion, includes $327 million of assumed debt, which represents Enbridge’s share of the indebtedness of Alliance. Because Pembina already has a 50 percent interest in Alliance, the transaction is expected to be completed with little issues. In the agreement, Pembina is also acquiring Enbridge’s 42.7 percent share of Aux Sable, at the terminus of the Alliance pipeline, which will give the company an 85 percent holding.